The Alberta government is increasing its property tax

The provincial property tax (i.e. education requisitions) is going up to help pay for schools. While this is a tax from the Alberta government, it is collected by the Town on your municipal property tax bill. The Town has no control over this tax, but we have to collect it for the province.

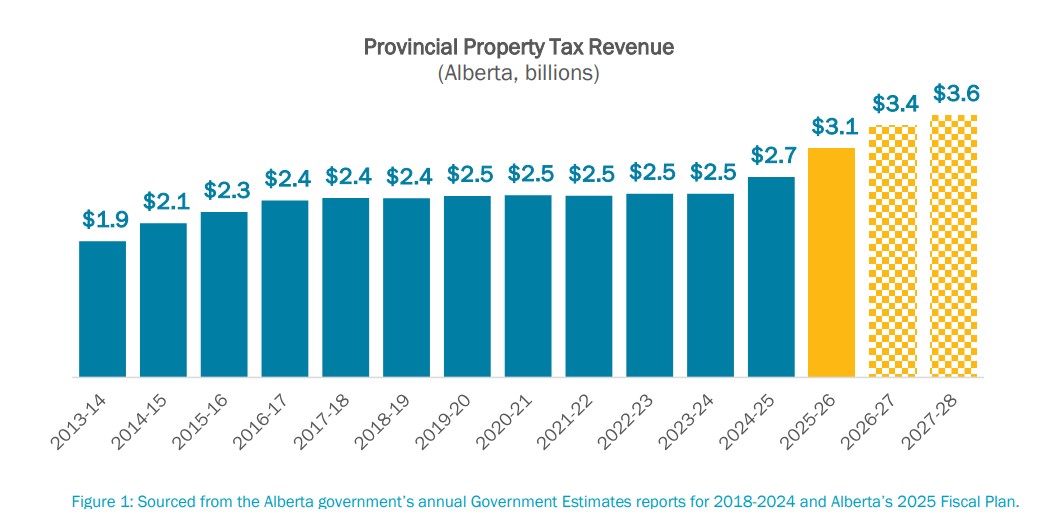

Between 2025 and 2027, the Government of Alberta plans to increase provincial property taxes by almost $1 billion, bringing the total provincial tax on property owners to $3.6 billion. These increases are part of the Alberta government’s new plan for provincial property taxes to cover one-third of the cost to run Alberta’s K-12 schools.

Source: Alberta Municipalities

What does that look like in Okotoks?

For many years, education requisition increases in Okotoks were modest and stable, but beginning in 2024 they rose sharply, increasing by more than $9 million in just three years—nearly a 60% cumulative increase.

- In Okotoks the provincial education tax is estimated to see about a 19% increase in 2026 because our assessment base grew more than the provincial average.

- For an average single-family home ($730,000 assessed), the 2026 education tax is estimated at $1,878. That equals about a $287 increase for Okotoks homeowners.

- In Okotoks, the provincial education tax was 23% in 2025, which was also much higher than the provincial average of 14%.

The graph below shows how education requisitions have increased considerably over the last 3 years in Okotoks:

- 2023: $15.1 million

- 2024: $16.7 million (+11%)

- 2025: $20.6 million (+23%)

- 2026: $24.4 million (+19%)

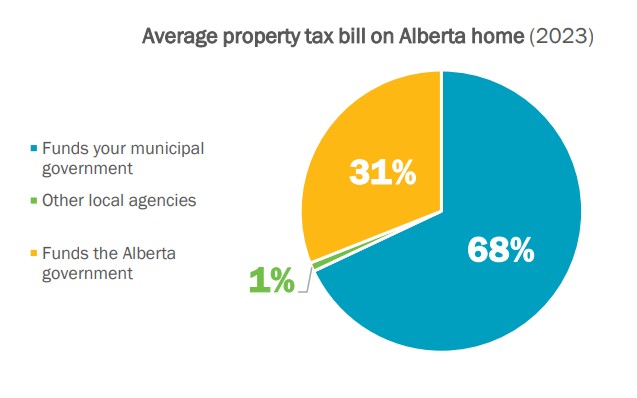

How much do you pay in provincial property taxes?

On average, almost one-third of property taxes on homes in Alberta is a tax by the Alberta government. The other two-thirds is the municipal property tax that is set by Okotoks Town council to pay for services in our community, like roads, recreation, fire, and policing.

Source: Alberta Municipalities

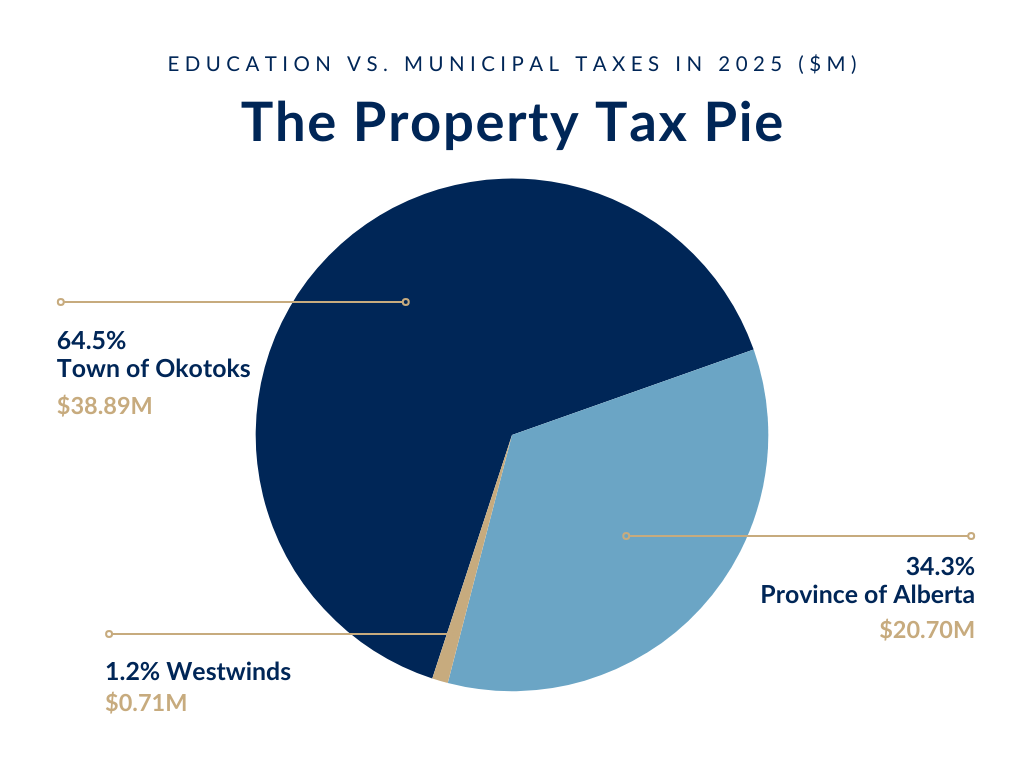

What does that look like in terms of taxes collected in Okotoks?

In 2025:

- $38.893M in municipal property taxes to support every day services like parks, recreation, and road maintenance

- $20.703M in Provincial education taxes to pay for schools

- $0.711M to support Westwind Communities