Alberta law says municipalities can’t plan to spend more than we bring in with taxes and other revenue. So, when costs go up, Council has only two options:

- Spend less money, which may mean cutting back on services for our community, or

- Find money somewhere else, usually by raising municipal property taxes or fees

Municipal budget restrictions, cost savings, & your property taxes

Where you pay your taxes

Local municipal governments, including Okotoks, are different from the federal and provincial governments because we can generally only collect money through:

- Property taxes

- Fees for services to homes and businesses, like water, garbage pickup, and recycling

- User fees, like paying to use the swimming pool, arena, or to join a program

Provincial laws also restrict municipal governments so we:

- Can’t create new taxes

- Can’t borrow money beyond a set limit

- Have to pass a balanced budget

Because of these provincial laws, the Town's municipal tax rate must always be set high enough to cover all our costs for the year.

The Government of Canada uses income taxes, GST, and other taxes to raise the money it needs to provide the many services Canadians need to build a strong and safe national society. The federal government can go into as much debt as it needs to pay for services. They can also plan for a budget deficit, that is, it can spend more than it earns in a year.

The Government of Alberta uses income taxes, property taxes, royalties on oil and gas, and other taxes to raise the funds it needs to pay for services like healthcare, education, and social supports. Like the federal government, the Alberta government can create new taxes, go into as much debt as it can afford, and can plan for a budget deficit.

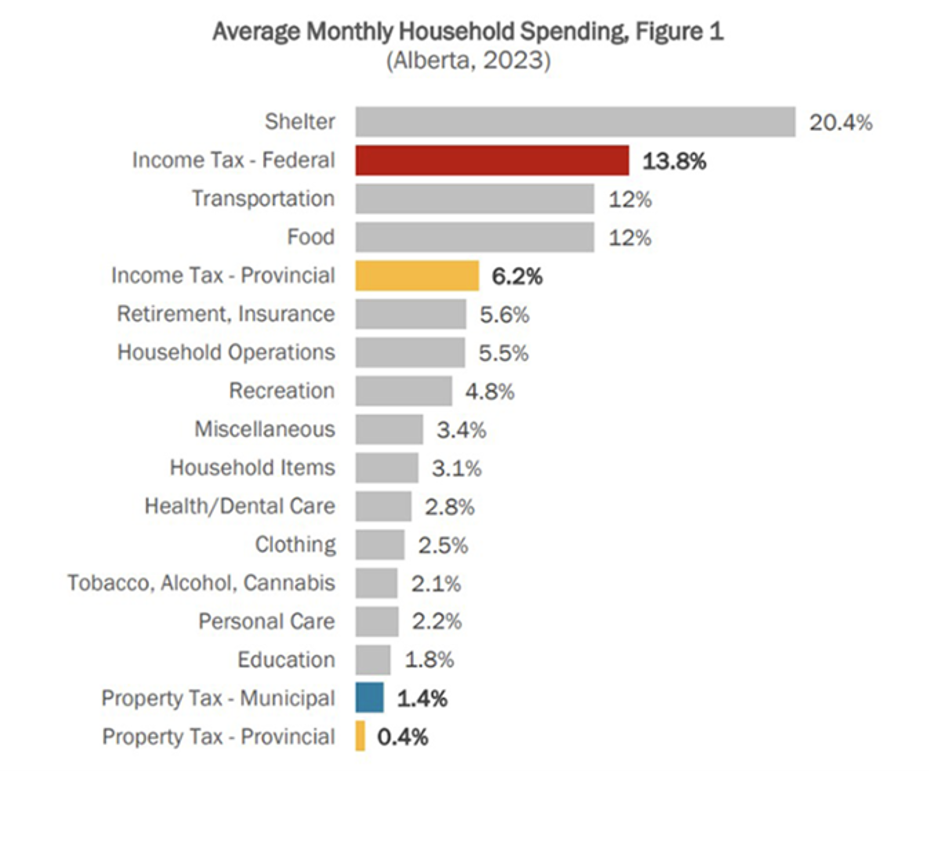

Looking at your monthly spending, how much of your pay is supporting taxation?

21.5%

Of that 21.5% of taxation, how much actually makes its way to the municipality?

1.4%

Source: Alberta Municipalities